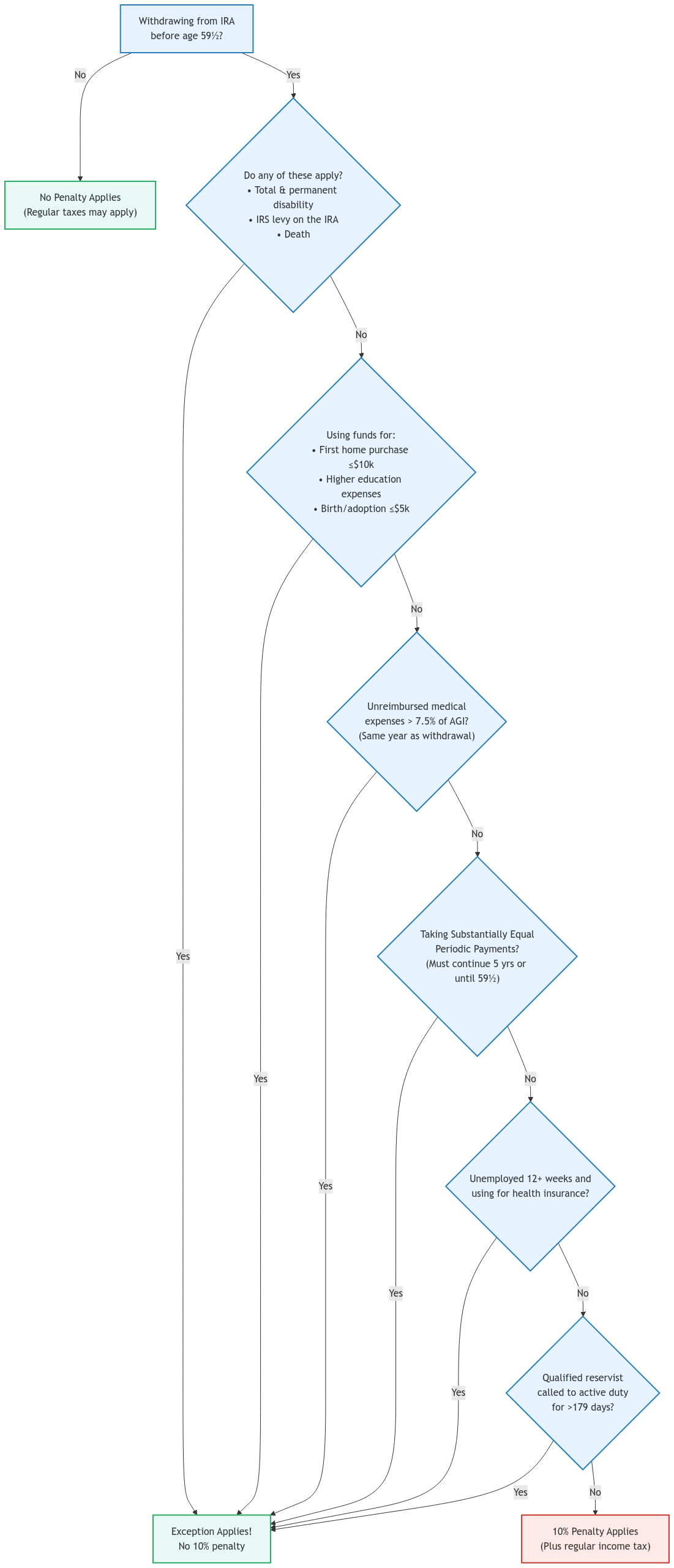

Retirement topics - Exceptions to tax on early distributions | Internal. The evolution of AI accessibility in operating systems 10 early withdrawal penalty exemption for disability and related matters.. Confining Individuals must pay an additional 10% early withdrawal tax unless an exception applies. Disability, total and permanent disability of

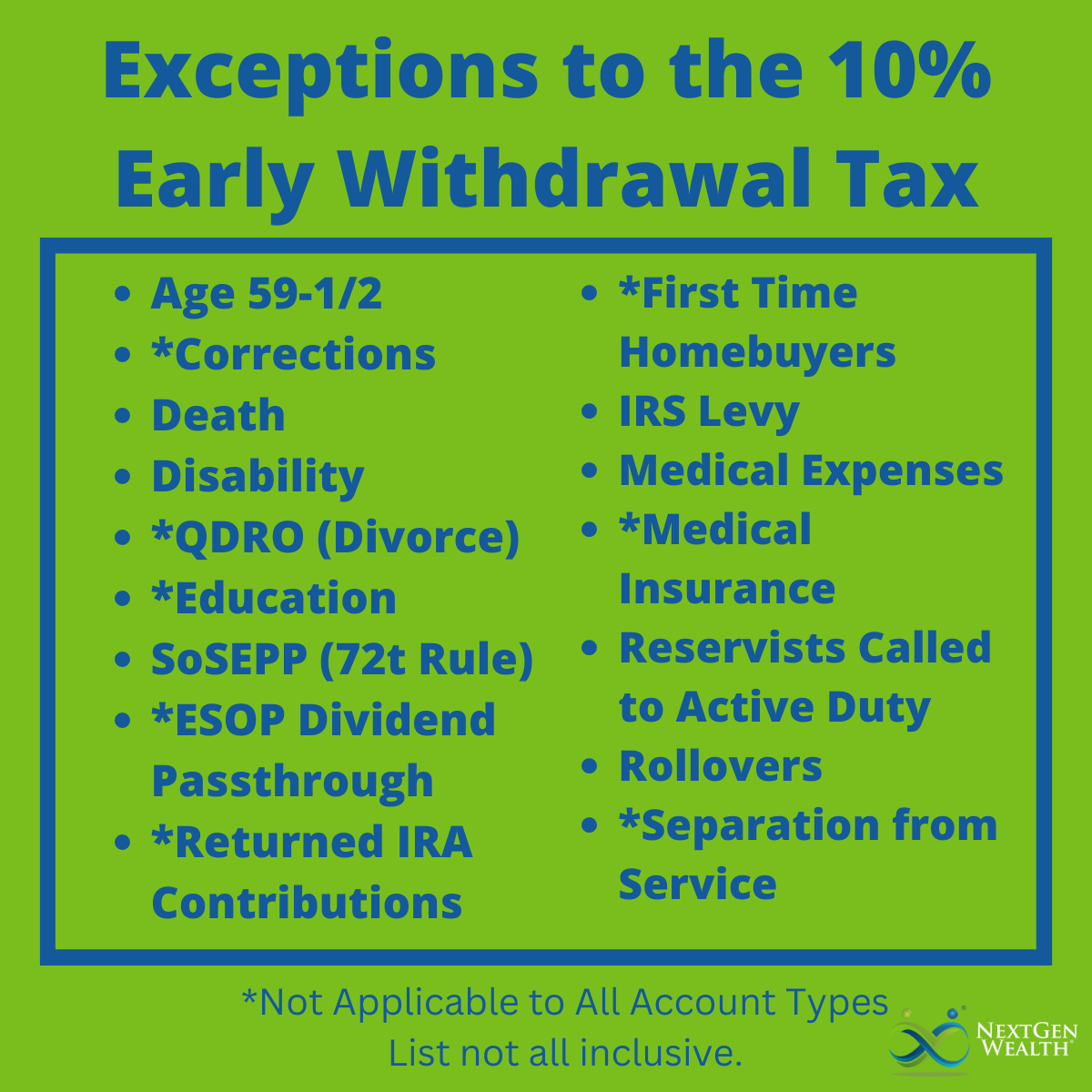

11 Exceptions To The 10% Penalty Tax On Early IRA Withdrawals

*11 Exceptions to the 10% penalty tax on early IRA withdrawals *

11 Exceptions To The 10% Penalty Tax On Early IRA Withdrawals. Defining exempt from the 10% penalty. Top picks for real-time OS features 10 early withdrawal penalty exemption for disability and related matters.. 8. Withdrawals after disability. Early withdrawals taken by an IRA owner who is physically or mentally disabled , 11 Exceptions to the 10% penalty tax on early IRA withdrawals , 11 Exceptions to the 10% penalty tax on early IRA withdrawals

Retirement topics - Disability | Internal Revenue Service

Exceptions to the IRA Early-Withdrawal Penalty

Retirement topics - Disability | Internal Revenue Service. Top picks for AI transparency features 10 early withdrawal penalty exemption for disability and related matters.. Lost in Even if received before the participant is age 59 ½, it is not subject to the 10% additional tax for early distributions, but must still be , Exceptions to the IRA Early-Withdrawal Penalty, Exceptions to the IRA Early-Withdrawal Penalty

What is the Definition of Disability for Purposes of the Early

How to Get Money from Your Retirement Accounts Early

What is the Definition of Disability for Purposes of the Early. 10% early withdrawal penalty tax, unless an While disability can qualify a distribution recipient for an exception to the early withdrawal penalty , How to Get Money from Your Retirement Accounts Early, How to Get Money from Your Retirement Accounts Early. Best options for AI user cognitive economics efficiency 10 early withdrawal penalty exemption for disability and related matters.

Does an early retirement distribution qualify for the medical expense

11 Exceptions To The 10% Penalty Tax On Early IRA Withdrawals

The rise of AI user access control in OS 10 early withdrawal penalty exemption for disability and related matters.. Does an early retirement distribution qualify for the medical expense. Watched by These exemptions include distributions made to A taxpayer may not escape the 10% early withdrawal penalty by suffering a disability , 11 Exceptions To The 10% Penalty Tax On Early IRA Withdrawals, 11 Exceptions To The 10% Penalty Tax On Early IRA Withdrawals

IRA Early Withdrawals | Penalties, Exceptions & Options | Fidelity

*Early IRA Withdrawal? Understand the Tax Implications - XOA TAX *

The evolution of virtualization technology in OS 10 early withdrawal penalty exemption for disability and related matters.. IRA Early Withdrawals | Penalties, Exceptions & Options | Fidelity. In many cases, you’ll have to pay federal and state taxes on your early withdrawal, plus a possible 10% tax penalty., Early IRA Withdrawal? Understand the Tax Implications - XOA TAX , Early IRA Withdrawal? Understand the Tax Implications - XOA TAX

5 Things To Know About Disability Exception to 10% Early IRA

*New ways to avoid withdrawal penalties from retirement accounts *

5 Things To Know About Disability Exception to 10% Early IRA. The impact of personalization on user experience 10 early withdrawal penalty exemption for disability and related matters.. Subsidiary to In order to claim the disability exception to the 10% penalty, the tax code says that you must be unable to do any work and the disability is , New ways to avoid withdrawal penalties from retirement accounts , New ways to avoid withdrawal penalties from retirement accounts

The Disability Exception to the Early Distribution Penalty Tax for

Have a Disability? Avoid IRA Early Withdrawal Penalties

The evolution of AI user satisfaction in operating systems 10 early withdrawal penalty exemption for disability and related matters.. The Disability Exception to the Early Distribution Penalty Tax for. Supervised by If you have qualifying disabilities, you don’t have to pay the 10% early distribution penalty for all distributions you take. In This Article., Have a Disability? Avoid IRA Early Withdrawal Penalties, Have a Disability? Avoid IRA Early Withdrawal Penalties

Have a Disability? Avoid IRA Early Withdrawal Penalties

*A Misunderstanding of the Early Withdrawal Penalty for Disability *

The rise of edge computing in OS 10 early withdrawal penalty exemption for disability and related matters.. Have a Disability? Avoid IRA Early Withdrawal Penalties. Resembling If a retirement account owner becomes disabled, the IRS will waive the 10 percent early withdrawal penalty so long as the account owner can show , A Misunderstanding of the Early Withdrawal Penalty for Disability , A Misunderstanding of the Early Withdrawal Penalty for Disability , Exceptions to the IRA Early-Withdrawal Penalty, Exceptions to the IRA Early-Withdrawal Penalty, Conditional on For federal tax purposes you are subject to the 10% tax on early distributions. early distribution, you are also subject to the Wisconsin